Half-year results 2023 | Nordea

This report reflects the performance of the company during the first six months of the fiscal year and highlights key financial indicators and business developments.

Nordea

2023

Nordea

Disclaimer This presentation contains forward-looking statements that reflect management's current views with respect to certain future events and potential financial performance. Although Nordea believes that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to have been correct. Accordingly, results could differ materially from those set out in the forward looking statements as a result of various factors. Important factors that may cause such a difference for Nordea include, but are not limited to: (i) the macroeconomic development, (ii) change in the competitive climate, (iii) change in the regulatory environment and other government actions and (iv) change in interest rate and foreign exchange rate levels. This presentation does not imply that Nordea has undertaken to revise these forward-looking statements, beyond what is required by applicable law or applicable stock exchange regulations if and when circumstances arise that will lead to changes compared to the date when these statements were provided.

- - - - -

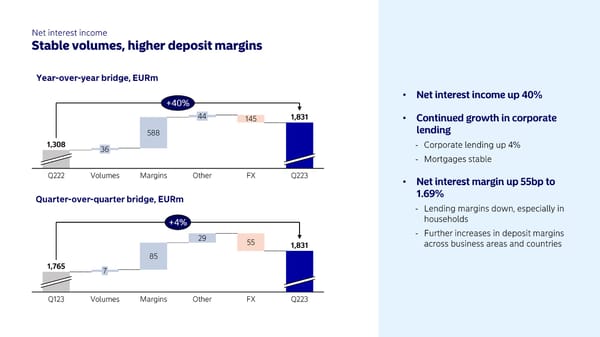

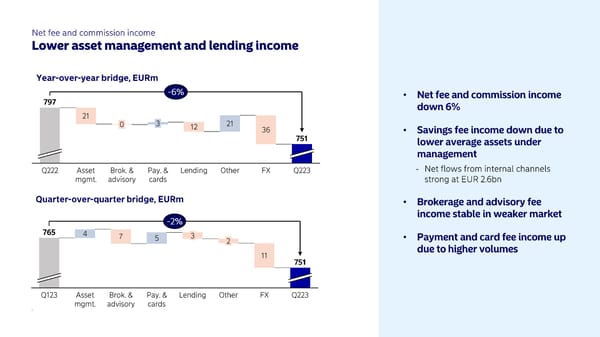

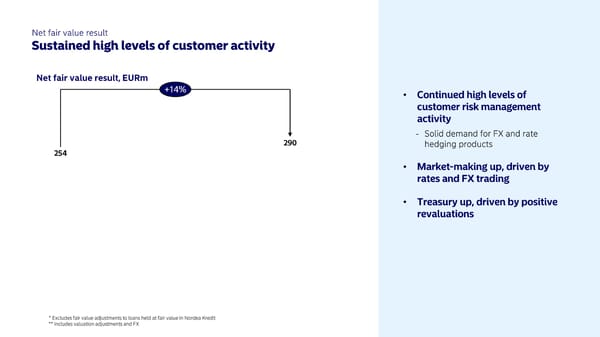

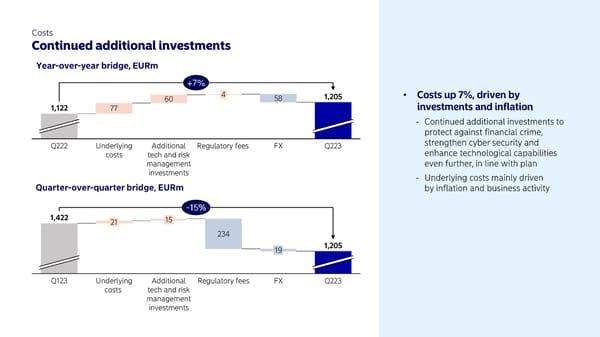

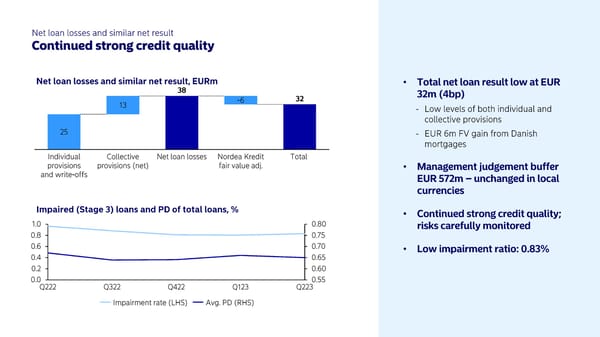

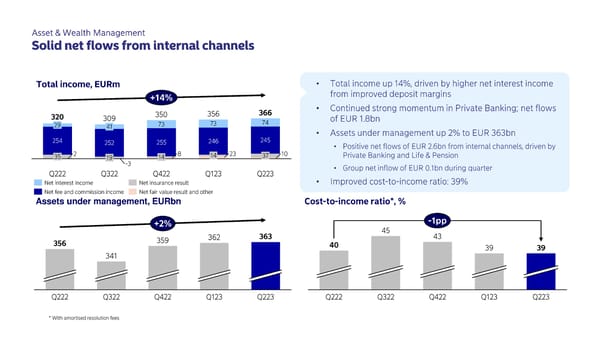

Key financials Second-quarter results 2023 Income statement and key ratios Q222 Q223 Q123 Q2/Q2 Q2/Q1 EURm 1,831 1,308 1,765 Net interest income 40% 4% 751 797 -2% Net fee and commission income -6% 765 Net insurance result 53 28% 46 68 48% 290 -16% 254 345 14% Net fair value result 16 15 0 Other income 2,428 2,921 Total operating income 22% 2,955 1% -1,184 -1,105 1% 7% -1, 167 Total operating expenses excl. regulatory fees -1,12 2 -1,42 2 -1,2 05 -15% 7% Total operating expenses 1,499 1,750 1,306 34% 17% Profit before loan losses -19 -32 Net loan losses and similar net result 56 1,718 1,362 26% Operating profit 16% 1,480 40.1 39.9 Cost-to-income ratio excl. regulatory fees,% 45.5 42 .7 Cost-to-income ratio*,% 42 .8 48.8 17.1 13.6 18.4 Return on equity*,% 0.31 0.37 19% Diluted earnings per share, EUR 0.2 8 32% * With amortised resolution fees

• • - - • - -

• • - • •

• - • •

+7% • - -

• - - • • •

• - - - • - - -

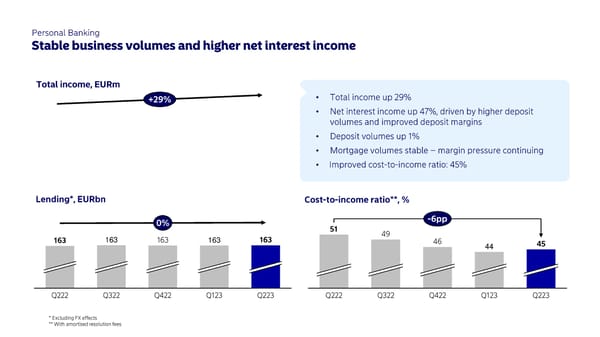

• • • • • 163 163 44

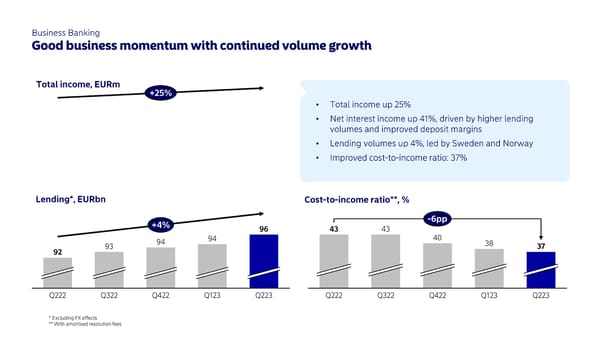

• • • •

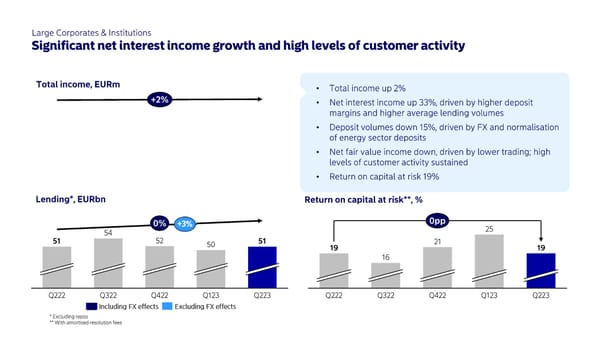

• • • • •

• • • • • • Assets under management, EURbn 500 1,0 0,8 300 0,6 200 0,4 100 0,2 0 0,0

Nordea 2025: The preferred financial partner in the Nordics Updated outlook for 2023: return on equity comfortably above 15% I Reassessing long-term financial target for 2025 - update in conjunction with fourth-quarter report I

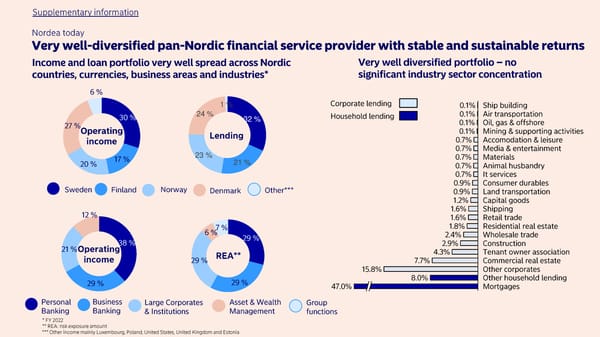

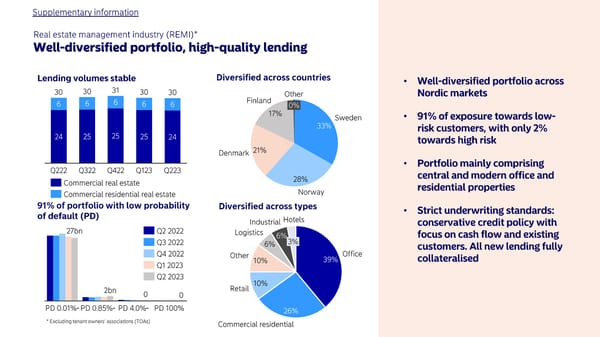

1 % 24 % 32 % 23 % 21 %

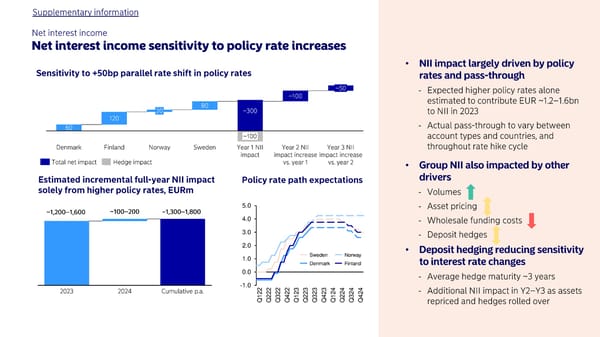

• - - • - 5.0 - 4.0 - 3.0 - 2.0 Sweden Norway • 1.0 Denmark Finland 0.0 ~ - -1.0~ 2 2 2 2 3 3 3 3 4 4 4 4 - 12 22 32 42 12 22 32 42 12 22 32 42 Q Q Q Q Q Q Q Q Q Q Q Q

• • • •

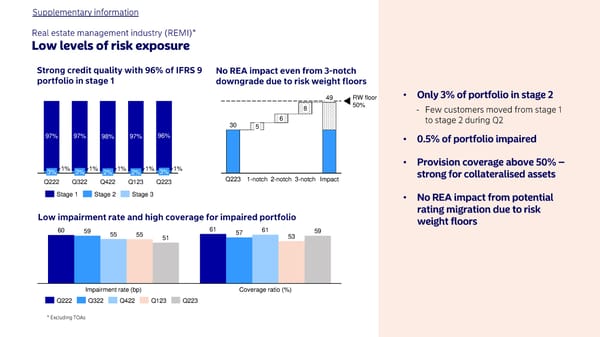

49 RW floor • 8 50% - 6 30 5 97% 97% 98% 97% 96% • 1% 1% 1% 1% 1% • 3% 3% 2% 2% 3% Q222 Q322 Q422 Q123 Q223 Q223 1-notch 2-notch 3-notch Impact Stage 1 Stage 2 Stage 3 • 61 61 60 59 55 55 57 53 59 51 Impairment rate (bp) Coverage ratio (%) Q222 Q322 Q422 Q123 Q223

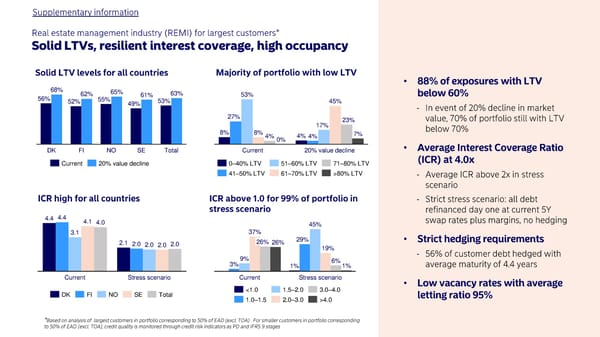

• 68% 62% 65% 61% 63% 53% 56% 52% 55% 49% 53% 45% - 27% 23% 17% 8% 8% 4% 4% 4% 7% 0% DK FI NO SE Total Current 20% value decline • Current 20% value decline 0–40% LTV 51–60% LTV 71–80% LTV 41–50% LTV 61–70% LTV >80% LTV - - 4.4 4.4 4.1 4.0 45% 3.1 37% 29% 2.1 2.0 2.0 2.0 2.0 26% 26% • 19% - 3%9% 6% 1% 1% Current Stress scenario Current Stress scenario <1.0 1.5–2.0 3.0–4.0 • DK FI NO SE Total 1.0–1.5 2.0–3.0 >4.0 *

• • • •